Many company owners and board members are familiar with some aspect of litigation – or at least the threat of it. The paperwork, the Zoom calls, the meetings, hearings, depositions, the back and forth, the cost—democracy might promise a jury of our peers and having your day in court, but adjudicating a dispute the traditional route is for many, impractical, long, and expensive.

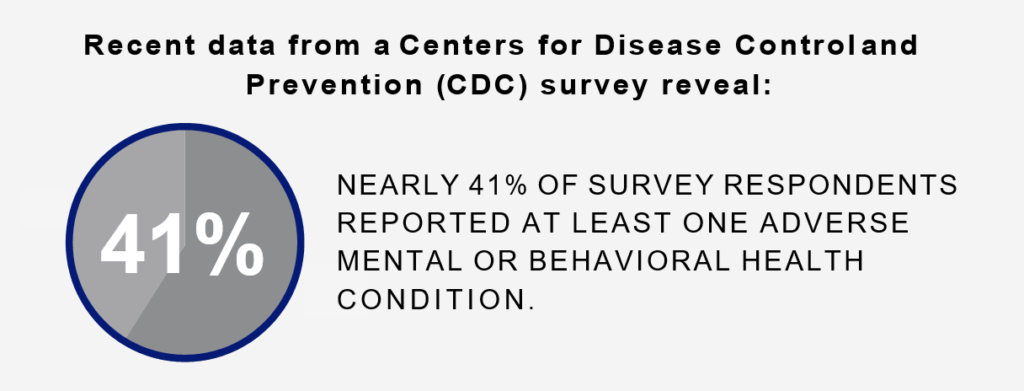

Shutdowns during the pandemic made that point all the more clear. Since the start of COVID-19, the volume of disputes has increased by more than 65% for companies over $1 billion, 50% of in-house legal teams are being pressured to spend less, and 75% of corporations want new preventative dispute mitigation procedures.

“The first question is never, ‘What is every single thing we can fight about?’ The first question out of any executive’s mouth is always, ‘This is a distraction—how quickly can we get this done and behind us?’ says attorney Rich Lee, whose 15 years in the field include general counsel roles at Livevol and Civis Analytics, a data science company stemming from Barack Obama’s 2012 re-election campaign. “Nobody, when you’re on the business side, ever relishes that dragged-out fight in any form.”

That’s why Lee teamed up with two fellow general counsels and a legal operations exec to form New Era ADR, a private arbitration and mediation platform rooted in efficiency, transparency, experience, and innovation. He says their process is 90% faster and up to 90% cheaper.

“Anytime there’s a potential dispute, it’s a massive distraction,” Lee says. “It costs the company a lot of money, a lot of time, and frankly, I think the worst part that’s immeasurable is that attention that you end up devoting to navigating a potential dispute. You could be in a sales meeting and you’ll be thinking about that dispute. It’s our firm belief that it just doesn’t have to be that way.”

We spoke with the New Era CEO and co-founder about the intricacies of arbitration vs. mediation, how to de-risk your transactions, and the best ways to protect yourself from arbitrary outcomes.

Read More